Benefit Plan participants not only gain a death benefit, but also numerous essential benefits such as:

-

Complete Asset Protection

Cover yourself from unexpected events that could put your assets at risk.

-

Estate Planning Advantages Built-in

Make sure your hard work is securely passed along to the appropriate family and business heirs.

-

Leverage Your Buying Power

You finance your house and car, why not your insurance benefits?

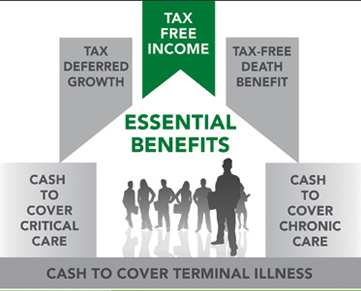

- Supplemental Retirement Income ( Deferred Comp )

- Permanent Life Insurance

- Cash for Chronic Illnes ( Long Term Care )

- Cash for Critical Care

- Immediate Cash for Terminal Illness

Contribution amounts are short in duration

and the policy is the sole collateral for the loan.

Your Plan can also provide solutions for:

- Partner Buy-Out

- Buy / Sell (leave early, get sick, or pass away)

- Affordable Succession Planning

- Recruiting and Retaining Key Employees

- Rewarding Key Executives

-

Tax Free Growth

Leverage your buying power with benefits backed by highly rated life insurance companies.

-

Contribution

Asset protection from the claims of business and personal creditors.

-

Covers Essential Benefits

Recieve investment growth without the immediate tax responsibilties.

Successful Estate Planning Starts Here.

We help our clients achieve long-term financial security by providing:

-

Cash for Payments of Debts, Final Illness Costs, Burial Expenses, & Necessary Taxes.

-

Funds for a Surviving Partner to Buy the Ownership Interest of the Deceased from Heirs.

-

Equitable Inheritance for off-farm heirs to keep the farm intact for on-farm heirs.

-

Cash for Payment of an Heir’s Contract to Buy a Farm or Business at the Death of the Owner.

-

Business Continuations Funds in case an operating heir dies while taking over the business.

-

An Estate where one would not otherwise exist.