What is Long-Term Care?

Long-term care (LTC) is the help provided to someone with severe cognitive impairment or a chronic illness or disability that prevents him/her from performing at least two activities of daily living which include bathing, dressing, eating, using the toilet, transferring, and continence. Long-term care may be provided at home, in an assisted-living/residential-care facility, or in a nursing home. If not planned for strategically, paying for long-term care can quickly deplete financial resources and reduce the quality of life for the person affected as well as caregivers.

What is Long-Term Care Insurance?

Long-Term Care Insurance (LTCI) is private insurance to cover the costs of long- term care for people with chronic health conditions and/or physical disabilities who are unable to care for themselves. If you don’t want to spend down your savings to qualify for Medicaid, LTCI can help you preserve assets for family members. LTCI generally covers the cost of nursing homes as well as certain agency services such as visiting nurses, home health aides, and respite care.

On average, LTCI policies cost Americans $888 per year at age 50, $1850 per year at age 65, and $5,880 per year at age 75. On a national average, nursing home care costs more than $51,000 per year. Based on your region, it can cost much more. Most life insurance companies offer LTCI individual coverage. Group coverage for yourself and possibly for your parents may be available through your employer or other associations.

A hypothetical example of how Annuity Care II can work:

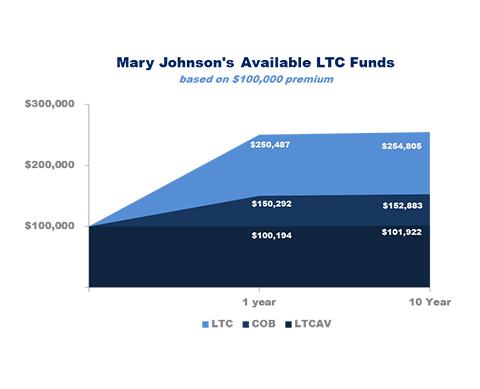

Mary Johnson is a 65-year-old who has $100,000 accumulated in savings for which she has no income needs. She elects to apply for Annuity Care II and pays this amount into the contract. Her premium creates a pool of total LTC benefits equaling $250,487.

Based on a minimum of 60 months of total protection available to her, she could access this amount for a monthly benefit of $4,175. So, using this example, Mary has $100,194 in her LTCAV and $150,292 in her COB Balance at the end of the first policy year. As the Long-Term Care Accumulated Value increases, so does the Continuation of Benefits Balance.

So by year 10, in our example, the LTCAV equals $101,922 and the COB Balance is $152,883, giving Mary a total amount of $254,805 available for qualifying LTC expenses. She could access this amount for a monthly benefit of $4,246.

Long-Term Care Insurance FAQ

How do I know if I need LTCI?

- Age and Life Expectancy: The longer you live, the more likely it is that you will need long-term care. The younger you are when you buy LTCI, the lower your premiums will be.

- Gender: Women are more likely to need long-term care because they have longer life expectancies and tend to outlive husbands.

- Family Situation: If you have a spouse or adult children, you may be more likely to receive care at home from family members. If family care is not available, paid care outside the home may be the only option. Different policies cover different types of care. Research policies that will cover the kind of care you expect to need that will be available in your area.

- Health Status: If chronic or debilitating health conditions run in your family, your risk could be greater than another person of the same age and gender.

- Income and Assets: You may choose to buy a long-term care policy to protect assets you have accumulated. On the other hand, if you have few assets or limited income, a long-term care policy is not a good choice. Some experts recommend you spend no more than 5% of your income on a long-term care policy.

How much will the policy pay in benefits?

The benefit amount usually ranges from $50 to $300 per day. You may choose a benefit period that is a specific number of days, months, or years. A maximum benefit period may vary from one year to remaining lifetime. It’s important to ask the insurance agent whether benefit amounts will increase with inflation and if that coverage will increase your premium.

What is typically excluded from coverage?

Every policy has an exclusion section. Some states do not allow certain exclusions. Many long-term care policies exclude coverage for:

- Mental and nervous disorders or diseases (except organic brain disorders)

- Alcoholism and drug addiction

- Illness casued by an act of war

- Treatment already paid for by the government

- Attempted suicide or self-inflicted injury

What should I look for in a plan?

The National Association of Insurance Commissioners (NAIC) developed this list of important insurance plan features to help you better understand what to look for in LTCI coverage.

- At least one year of nursing home or home health care coverage, including intermediate and custodial care. Nursing home or home health care benefits should not be limited primarily to skilled care.

- Coverage for Alzheimer's disease, should you develop the disease after buying the coverage.

- An inflation-protection program. Look for LTC coverage that lets you choose from these options:

- Automatically increasing the initial benefit level on an annual basis;

- A guaranteed right to increase benefit levels periodically without providing proof of good health satisfactory to the insurer; or

- Covering a specific percentage of actual or reasonable charges.

- A guarantee that the insurance plan cannot be canceled, non-renewed, or otherwise terminated because you get older or suffer deterioration in physical or mental health (such coverage is called "guaranteed renewable").

- The right to return the insurance plan within 30 days for any reason. This is called a “30-day free look.”

- No requirement that insurance plan holders must first:

- Be hospitalized in order to receive nursing home benefits or home health care benefits.

- Receive skilled nursing home care before receiving intermediate or custodial nursing home care.

- Receive nursing home care before receiving benefits for home health care.

What is the tax impact?

The Health Insurance Portability and Accountability Act of 1996 (HIPPA) encouraged the use of long-term care insurance. It changed tax law for LTCI contracts that meet certain federal standards. In general, HIPAA treats certain qualified long-term care contracts the same as health insurance for tax purposes.

- The premiums for these contracts are deductible in whole or in part.

- The benefit payments are excluded from personal income.

- The unreimbursed costs of qualified long-term care services are deductible as a medical expense.